The inventory has fallen roughly 20% since an earnings report on Wednesday.

Netflix revealed blockbuster subscriber development in a quarterly earnings report this week, however since then the corporate’s shares have plummeted greater than 20%.

The response on Wall Road marks the most recent indication of a profound shift in investor priorities away from subscriber development and towards the underside line, which holds implications for placing writers and actors in addition to the exhibits and films that find yourself on display screen, specialists informed ABC Information.

“The tide has turned,” Jessica Reif Ehrlich, an leisure {industry} analyst with Financial institution of America, informed ABC Information.

Netflix didn’t instantly reply to a request for remark.

This is what to find out about what the earnings report mentioned, why the inventory value fell and what it means for Hollywood.

What did Netflix earnings reveal in regards to the firm?

Netflix shared a whole lot of excellent news in its earnings report on Wednesday, Reif Ehrlich mentioned.

A password-sharing crackdown helped the streaming platform add 5.9 million subscribers over the three months ending June, which marked a staggering enchancment from the identical interval a 12 months in the past when the corporate misplaced practically 1 million subscribers, Netflix mentioned.

In all, Netflix mentioned it boasts about 232 million subscribers, far outpacing its nearest rival Disney+, which reported simply shy of 158 million subscribers in Might. (The Walt Disney Firm is the mum or dad firm of ABC Information).

In the meantime, Netflix’s free money circulation — a measure of how a lot cash is offered to an organization after it pays for working bills — grew by $1.5 billion to a complete of about $5 billion, the corporate mentioned.

The corporate, nevertheless, failed to fulfill expectations for income, which rose 2.7% from a 12 months earlier to $8.2 billion. Analysts anticipated $8.3 billion.

Why did Netflix’s inventory drop?

Related articles:

- https://bargame.xyz/rh-inventory-has-practically-tripled-over-the-final-5-years-can-it-do-it-again_/

- https://bargame.xyz/inventory-break-up-watch_-2-magnificent-development-shares-to-purchase-now-and-maintain-endlessly/

- https://bargame.xyz/may-cava-inventory-assist-you-obtain-an-early-retirement_/

- https://bargame.xyz/meta-platforms-vs-alphabet_-which-large-tech-inventory-is-a-greater-buy_/

- https://bargame.xyz/inventory-cut-up-watch_-3-supercharged-development-shares-that-may-cut-up-their-shares-in-2023/

The miss on income — which Reif Ehrlich known as a “modest disappointment” — was sufficient to ship the corporate’s inventory tanking.

The subscriber development, whereas robust, is poised ship lower than it seems as a result of most of the shoppers reside in worldwide markets the place the corporate reaps much less income per buyer, she added.

On Thursday, a day after the report, Netflix shares fell greater than 8%. In afternoon buying and selling on Friday, the inventory had dropped roughly one other 11%.

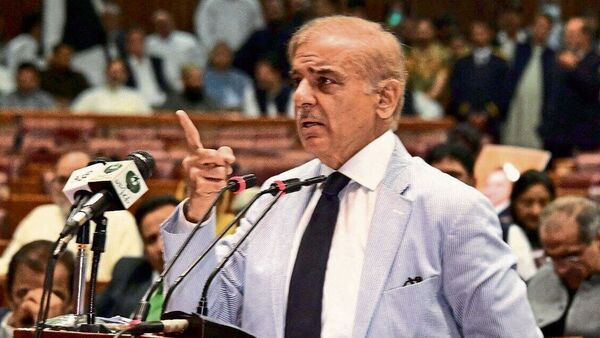

Cynthia Nixon, middle, carries an indication on the picket line outdoors Netflix, July 21, 2023, in New York. Evan Agostini/Invision/AP

Regardless of the latest losses, Netflix inventory has climbed roughly 44% this 12 months — an indication that the investor response this week suggests a judgment about an overvalued inventory reasonably than an unhealthy firm, Luis Cabral, a professor of economics and worldwide enterprise at New York College who focuses on the leisure sector, informed ABC Information.

“From the start of the 12 months, it is truly doing fairly properly,” Cabral mentioned.

Nonetheless, the inventory falloff is the most recent signal of an industry-wide shift away from the breakneck subscriber development that marked an early part within the sector as corporations jockeyed to accrue a big buyer base that would shoulder out opponents, he mentioned. Now, he added, corporations like Netflix want to indicate that they are truly creating wealth and delivering income.

What does Netflix’s inventory decline say in regards to the streaming {industry}?

The deal with bottom-line efficiency means streaming corporations like Netflix are more and more attentive to minimizing prices and enhancing the income derived from viewers, Reif Ehrlich mentioned.

Meaning the businesses are much less more likely to bankroll costly exhibits or motion pictures, she added. Some corporations, together with Netflix, have even imposed layoffs going again to final 12 months as a method of slicing prices.

The continued strike amongst writers and actors provides an extra layer of monetary uncertainty, she added.

“Given the strikes and the main target of the market on profitability, they’re actually going to have to consider content material prices, advertising and marketing prices, overhead,” Reif Ehrlich mentioned.

Viewers ought to anticipate a smaller number of exhibits even after the calendar returns to regular following the strikes, she added. “There was this rush to drive content material over the past three to 5 years,” she mentioned. “All people goes to tug again.”